Economy & Tech

China Conflict Increases Opportunities for Japan-Vietnam Trade and Investment

Published

5 years agoon

By

Anders Corr

China’s increasingly belligerent approach to regional and international politics and trade is causing investors, importers, and exporters to diversify risks away from China and into other markets.

Apple recently lost over USD 70 billion from its market capitalization as stock of the company, which is heavily invested in China’s consumer market and manufacturing, crashed 10% with the pressure of Apple’s weaker-than-expected earnings forecasts in China.

China had threatened consequences to U.S. companies like Boeing and Apple from the trade war. And, sure enough, those consequences are real. The strategy moreover stretches back to the founding of China in 1949, as evidenced by Britain’s leading recognition of the country in order to save its position in Shanghai, Hong Kong, and elsewhere.

Since the Hu Jintao era, there is statistical evidence that China uses trade to try and wrest political concessions in the form of other countries’ foreign policies. Businesses in Japan, South Korea, and Norway have been hit by China for their government’s policies on defense and human rights issues.

Rising Business Risks in China

Sharply rising risks to investment in China since Donald Trump became United States president in 2017 have made not only American but Japanese companies increasingly look elsewhere for opportunities. Vietnam is one such location, accelerating an already strong outlook for the Japan-Vietnam trade and investment relationship.

Vietnamese Prime Minister Nguyen Xuan Phuoc will be making investor pitches at the World Economic Forum in Davos in late January. He told Bloomberg news on January 20 that Vietnam expects growth in the range of 6.6% to 6.8%, and that it would keep the currency stable. He said Vietnam would be encouraging foreign business-friendly policies and free trade.

“We are ready to grab the opportunity,” he told Bloomberg. “We are trying to increase exports in both quantity and quality of our products, especially in which we have advantages, such as seafood, commodities, footwear and electronics.” He looks to exports to grow the economy above 6%, provide more jobs, and avoid the middle income trap.

Professor Junaid Shaikh and Vietnam’s Vice Director of the Industry and Trade Information Center Dinh Thi Bao Linh explained it this way in 2017: “Since the recent advances of China and its ambition in the South China Sea, big countries like the United States, Japan, and India have considered Vietnam a key partner in their new Asia strategies.”

They added, “Along with the economic integration and trade liberalization, Vietnam is opening its market with 100 million consumers and also many export opportunities, to international business and investors.”

In their 2019 Q1 country risk report on Vietnam, Fitch Solutions predicted that “Vietnam will seek increasingly close relations with the U.S. — and potentially India and Japan — in the defense sphere, as a hedge against China’s rising power in the region.”

My clients interested in Vietnam investments increasingly think that President Trump’s trade war with China has created Vietnam growth opportunities. China’s general belligerence against South Korean and Japanese companies, translated to U.S. investments, means that U.S. investors are looking to move their operations elsewhere, including to Vietnam.

The same logic applies to Japan, whose relations with China are even more strained judging by the number of military contacts over the East China Sea, and which has much more pre-existing foreign direct investment (FDI) in Vietnam than does the United States.

China increasingly links positive trade and investment relations to political concessions given by the U.S., Japan, Australia, and South Korea. When those political concessions are not forthcoming, China treats foreign companies in its market as hostages. Pressure is applied to vulnerable company profits in the hopes that their representatives in home capitals will use their political influence to effect the foreign or trade policy that Beijing seeks.

Apple CEO Tim Cook tried to reverse President Trump’s trade war, and for good reason. As the trade war gained steam, Apple’s revenue forecasts in China dipped and the company lost 10% of its stock value. This may help China’s diplomacy in the short-term, but in the long-term it just causes capital flight. Even Chinese investors are fleeing China.

Vietnam Benefits as China Alternatives Sought

Vietnam is one among the many likely beneficiaries of that capital flight.

The money has to go somewhere, and Vietnam’s leadership is hungry for investment and willing to make concessions to foreign investors. The country enjoys 6-7% GDP growth, low inflation, export-oriented markets, strengthening diplomacy that will lead to more exports, and has a cheaper yet comparatively-skilled labor market.

FDI (foreign direct investment) is perhaps the strongest long-term indicator of a positive economic relationship between two countries as FDI includes long-term sunk costs that would be most threatened by a downturn in bilateral relations. Investors typically put their money where the risk-return ratio is expected to be good for a long period.

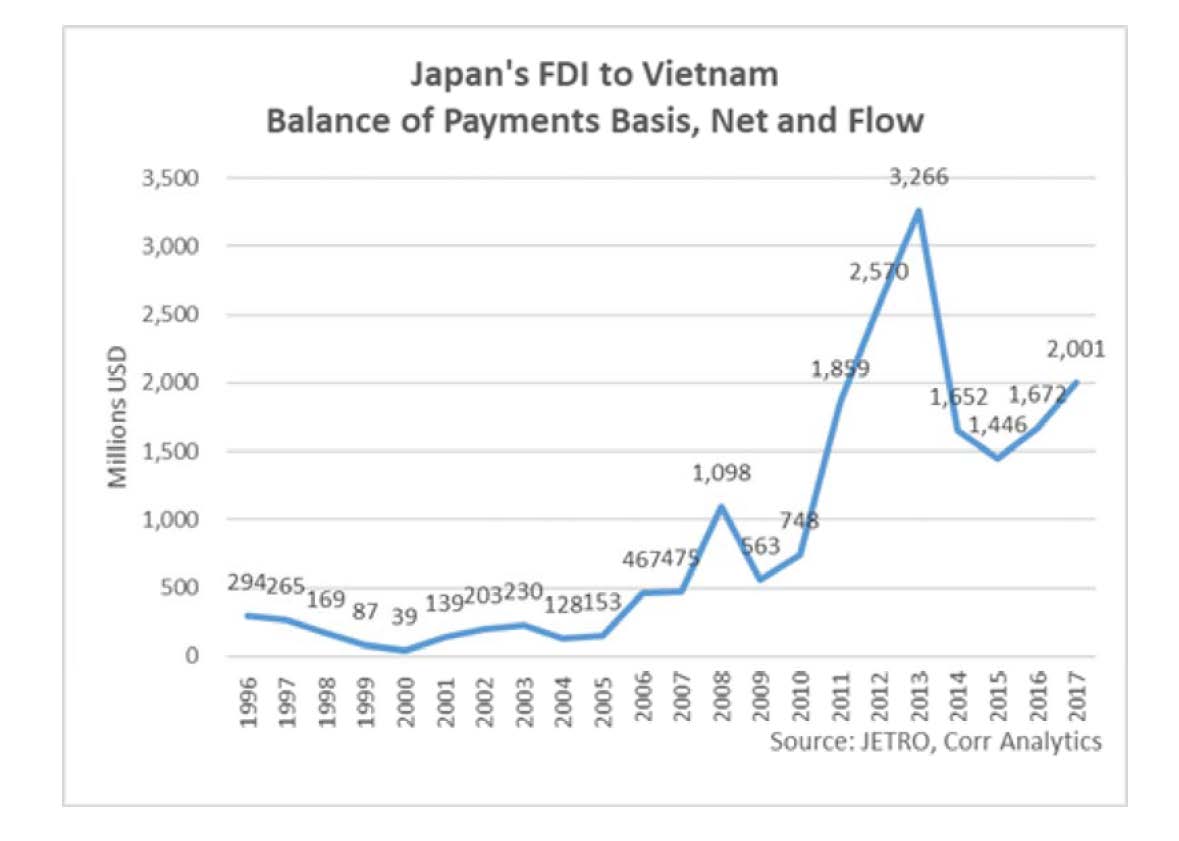

In 2000, Japanese FDI flow to Vietnam was just USD 39 million (balance of payments basis, net). That number hit a record USD 3.3 billion in 2013, and then dropped to a still substantial USD 1.4 billion in 2015. It has since risen to USD 2 billion in 2017.

Japanese FDI flow to Vietnam has increased as a percentage of all Japanese FDI flow as well. In 2000, it was just 0.12%, a number that increased to 1.19% in 2017. In that year, Japan had 397 FDI projects licensed in Vietnam that totaled in dollar terms more than any other country at USD 9.2 billion in total registered capital, according to the General Statistics Office of Vietnam.

Imports and exports between Japan and Vietnam are also strong. In 2017, Japan exported USD 15 billion to Vietnam, and imported USD 18.5 billion. This USD 3.5 billion balance of trade in Vietnam’s favor means that Vietnam exports more to Japan than Japan exports to Vietnam. That makes Japan a valuable source of foreign exchange for Vietnam, and it gives Vietnam a strong incentive to be a good trade partner to Japan.

Durability of Japan-Vietnam Business Relations

Indeed, an Asian Economic Journal study published in 2017 found that Japanese multinational enterprises in Vietnam have a particularly strong chance of surviving, compared to MNEs from many other nations, especially when they partner with state-owned enterprises and have a large ownership share.

The amount of Japan-Vietnam trade is rapidly increasing, with a year-on-year increase of 12.0% on Japanese exports to Vietnam and 14.1% on imports from Vietnam (year-on-year change, October 2018). Vietnam trade is truly a growth market for Japan, which can increasingly shift business to the country as commitments in China are wound down. There is plenty of room for more growth, as Japanese exports to the country are still only 2.2% of total exports, and imports are only 2.8% of total imports.

Multinational Projects in Vietnam

An example of Japanese FDI in Vietnam is the Nghi Son Power Station, south of Hanoi in Thanh Hoa province. The coal-fired power plant is in an economic zone created in 2005 that required substantial power.

Electricity of Vietnam awarded Japan’s Marubeni Corporation the USD 1.2 billion contract for the 600 megawatt first phase of the plant in 2010. Construction began immediately, and the first two 300 megawatt units powered up in June 2013 and June 2014, respectively.

In March 2013, Vietnam’s Ministry of Industry and Trade awarded a second contract for a 1,320 megawatt phase-two plant to a Japanese-Korean consortium that included Marubeni Corporation and Korea Electric Power Company (KEPCO). After the plant is built, the companies will operate it for 25 years, and then ownership will revert to Vietnam.

Funding for the USD 2.3 billion contract was finalized in April 2018, with the Japan Bank for International Cooperation (JBIC) and Export-Import Bank of Korea each providing a USD 560 million loan, and a group of banks from Japan, Malaysia, and Singapore providing the rest. A construction start rapidly followed in July 2018, with the plant planned for operations in 2022.

Economic Reforms Suit Investment

International investment and trade is sufficiently important to Vietnam that it is making major reforms to its economy in accordance with advice from its Japanese and other trade partners, as well as international organizations like the World Trade Organization (WTO).

Liberalization of Vietnam’s FDI policies date to its first FDI law, introduced in 1987 and amended in 1992, 1996, and 2000. Japanese FDI increased substantially after that date, as detailed above.

A Unified Law of Investment instituted equal treatment of foreign and domestic investors and was instituted in 2006. This, in compliance with Vietnam’s joining of the WTO in January 2007 and the 2009 Japan-Vietnam Free Trade Agreement (FTA) and Economic Partnership Agreement (EPA), led to a 700% increase in annual Japanese FDI flow to Vietnam between 2006 and the peak in 2013 as the market matured. Under the EPA, a 0% tariff rate was applied to 456 items including construction stones, aluminum, steel, sugar, equipment, machinery, vehicle parts.

During the first quarter of 2018, Vietnam’s Ministry of Finance produced 10 draft decrees related to preferential tariff rates in 2018-2020 for its 10 FTAs. These included Vietnam’s FTA with Japan.

Most goods started enjoying 0% import tariffs on January 1, 2018. Other goods will see a gradual reduction of tariffs until 2022. That will increase the Vietnamese manufacturing sector’s substantial imports of Japanese intermediate industrial inputs that feed the production process.

Vietnamese Prime Minister Nguyen X Phuanuc met with Japanese Foreign Minister Taro Kano in Hanoi September 11, 2018, at the World Economic Forum on ASEAN 2018, hosted by Vietnam. The Prime Minister recommended increased economic linkages between the two countries at the meeting, and for Japan to increase its activities in Vietnam’s Mekong region. In 2019, in accordance with the ASEAN-Japan Comprehensive Economic Partnership, existing 5% import taxes will be removed in Vietnam for various commodities.

Future Challenges

There will be continued bumps in the road of Japanese investment and trade with Vietnam. These include issues with corruption, infrastructure, labor disputes, and the economic slowdown in China.

But Japanese investors have consistently increased FDI flows to Vietnam since 2015. In addition, Japanese officials are working with their Vietnamese counterparts to continue the process of gradual improvement to Vietnam’s political and economic conditions that began over 30 years ago.

A Chinese economic slowdown should be seen as a long-term opportunity, not a short-term cost, to economic growth in Vietnam and Japan. With the China trade war gathering steam, pressure to divert global investment from China to other markets will only increase the FDI and trade flow with Vietnam.

Japan’s pioneering Vietnam investments over the years will increase, as will Japan’s benefit from other international investors following its lead into the Mekong area.

Author: Anders Corr

You may like

-

Birth of an Asian NATO: A New Strategic Alliance Emerges Amid Regional Tensions

-

US Election Hampers Nippon Steel Buyout in a Potential Windfall for China

-

Trump 2.0: What Would It Mean for Japan

-

Why South Korea and Japan Should Overcome the Nuclear Weapons Taboo

-

Biden Says US Steel Must Remain American

-

[Speaking Out] Trump Comeback: Why Japan Needs to Be Ready

You must be logged in to post a comment Login