The Bank of Japan raised its interest rate target for the second time in 2024, confident that wage hikes and tax cuts will help consumer spending...

In this new "world with interest rates," the BOJ must carefully time its reductions and manage its policy to avoid causing turmoil in the markets.

Factors such as disaster resilience, wage hikes, growth investing, and a cautious exit from monetary easing are essential to reboot the Japanese economy.

The Bank of Japan will allow 10-year bond yields to rise as high as 1%. But it risks impeding Japan's economic recovery unless it contains speculative...

New Bank of Japan Governor Ueda must strive for adaptability and avoid causing market turmoil as he steers the monetary-easing policy toward an exit strategy.

As Bank of Japan chief, Kazuo Ueda will be given the difficult task of maintaining monetary easing for the present while edging toward an "exit strategy."

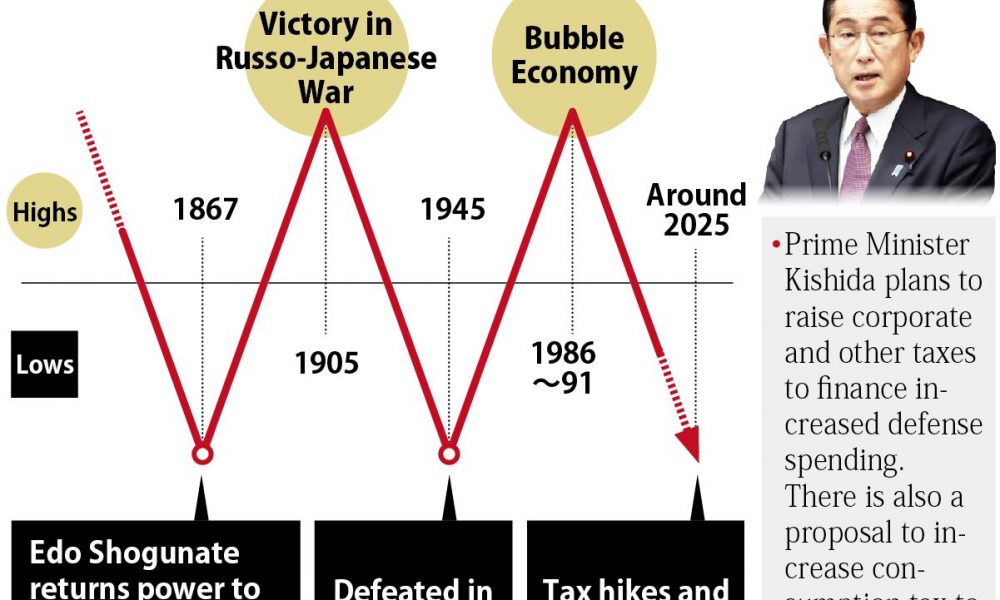

The 40-year cycle theory says that Japan's national power will hit a low point in 2025. To avoid this, Japan needs prudent and well-balanced monetary policies.

Long-term interest rates and the value of the yen spiked in response to the abrupt policy shift by the Bank of Japan. Meanwhile, stock prices plummeted.

Monetary policies will have to be considered as the spread of the novel coronavirus presents “the biggest uncertainty for Japan’s economy,” Bank of Japan (BoJ)...

More than once this writer has come out with the view that the government should drop the planned consumption tax rate hike slated to rise...

Japan is finally enjoying some flattering press. After years of negative stories about its economy in the international media, the news is good. “Japan’s Economy is...