Following the stock market nosedive, the government and Bank of Japan need to make a cool-headed financial policy.

Japan's top securities firms, including SMBC Nikko and Daiwa, reveal solid performance fueled by a booming stock market and the NISA initiative.

"With 90% of our domestic workforce comprising women, our achievements are inseparable from their active participation" — CEO Kikuta of Dai-ichi Life Holdings

With Japanese stocks reaching all-time highs, Japan should use this opportunity to revitalize industries, implement reforms, and invest in digital technology.

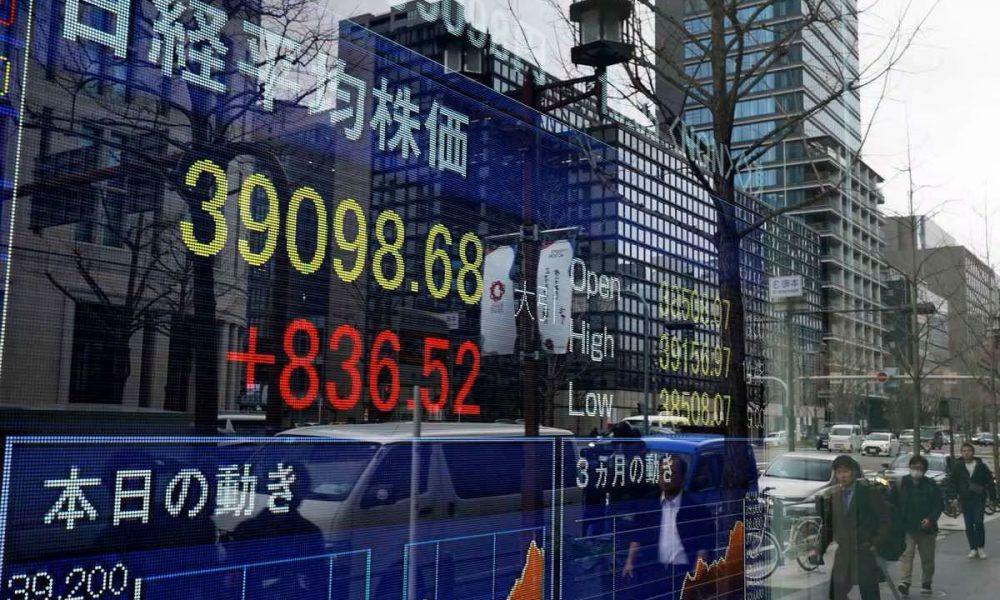

Fueled by tech stocks, investor optimism, and a weak yen, the Nikkei closed at 40,109 — nearly 11 years after Japan implemented its monetary-easing policy.

In turn, Nikkei-triggered reforms will attract further investment and contribute to the revitalization of Japan’s markets.

Japan's stock market is approaching all-time highs, bringing some professionals to reminisce with cute bubble-era slogans. What's driving the market this time?

As Mitsubishi stops making cars in China, business leaders express concern about cutthroat competition and anti-foreigner sentiment.

Prime Minister Kishida wants 30% of board members in top companies to be women by 2030, and internal corporate talent development to help bring this about.

The main share index in Japan, the Nikkei 225, has been breaking records set in the 1990s. Here's what experts are saying about its remarkable bull...

Dai-ichi Life's chief economist believes strong Japanese stocks are due to corporate earnings and shareholder return policies that met investor expectations.

There’s a failure, for example, to sufficiently narrow down companies that qualify for the new Prime section. Investors need clarity.