The BOJ decision signals a major shift towards economic recovery, but it must closely monitor for the fallout from its new monetary policy.

The Nikkei average has hit new highs and the Bank of Japan finds itself holding too many equities. The challenge now is to return these to...

The Bank of Japan will allow 10-year bond yields to rise as high as 1%. But it risks impeding Japan's economic recovery unless it contains speculative...

New Bank of Japan Governor Ueda must strive for adaptability and avoid causing market turmoil as he steers the monetary-easing policy toward an exit strategy.

The middle of the memoir focuses on Shinzo Abe in his second term, Abenomics and diplomacy, through which he reshaped Japan's place among global statesmen.

Incoming BoJ Governor Kazuo Ueda inherits his office with Japan in far better shape than the disaster Haruhiko Kuroda turned around when he took over in...

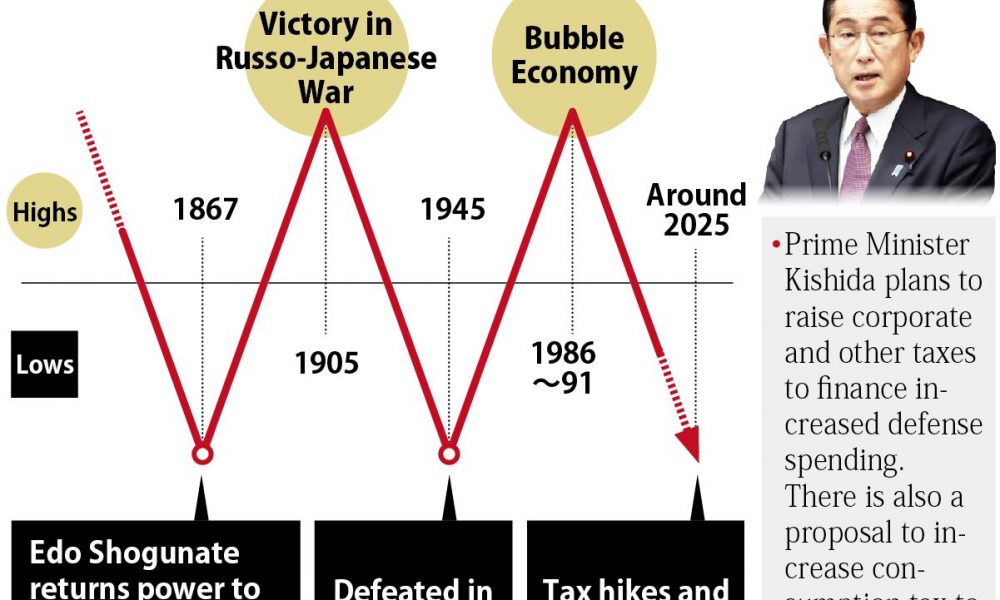

The 40-year cycle theory says that Japan's national power will hit a low point in 2025. To avoid this, Japan needs prudent and well-balanced monetary policies.

With predictions of rising inflation, trade unions say workers deserve a 5% pay rise. Meanwhile, BOJ reviews monetary policy against the threat of recession.

Long-term interest rates and the value of the yen spiked in response to the abrupt policy shift by the Bank of Japan. Meanwhile, stock prices plummeted.

"Market mechanisms are always followed by tears and laughter," says Sojitz Research Institute Chief Economist Tatsuhiko Yoshizaki on the weak yen.

To counter the yen’s depreciation, the Kishida government must provide financial help to households and businesses, and request firms to raise wages.

The strong US dollar is weighing on the global economy, including developing economies whose currencies are declining and foreign debt burden increasing.